The world of finance is experiencing a powerful shift. Finance is no longer seen as just bookkeeping or number-crunching. Today, it plays a strategic role in how organizations grow, compete, and create value. Modern finance teams work with real-time data, cloud technologies, automation, artificial intelligence, digital payments, and advanced analytics. The pace of innovation in financial technology — also known as fintech — has transformed how companies manage money, monitor performance, and build future plans.

Over the past decade, financial operations have moved away from paper files, manual entries, and isolated systems. Instead, businesses now rely on digital tools that simplify accounting, reduce errors, improve collaboration, and help decision-makers act faster. Technologies such as AI-powered forecasting, automated invoicing, digital payments, real-time reconciliation, and compliance automation are no longer “nice to have” tools — they have become essentials for high-performing finance teams.

Because of this rapid shift, finance teams today face a new kind of pressure. They must modernise or risk falling behind competitors who are already using advanced financial systems. Organizations that still depend on outdated software, manual spreadsheets, and disconnected processes often struggle with delays, inaccuracies, compliance risks, and slow decision-making.

In this evolving environment, the Zoho Finance Suite emerges as a complete, cloud-based financial ecosystem designed to support modern businesses. With connected applications built specifically for accounting, billing, inventory, subscription management, payments, and expense control, Zoho Finance helps companies move confidently into the future.

This blog explores the major emerging trends shaping the financial technology landscape, the impact these trends have on modern finance functions, and how Zoho’s smart financial applications help finance teams stay ahead and work more efficiently than ever before.

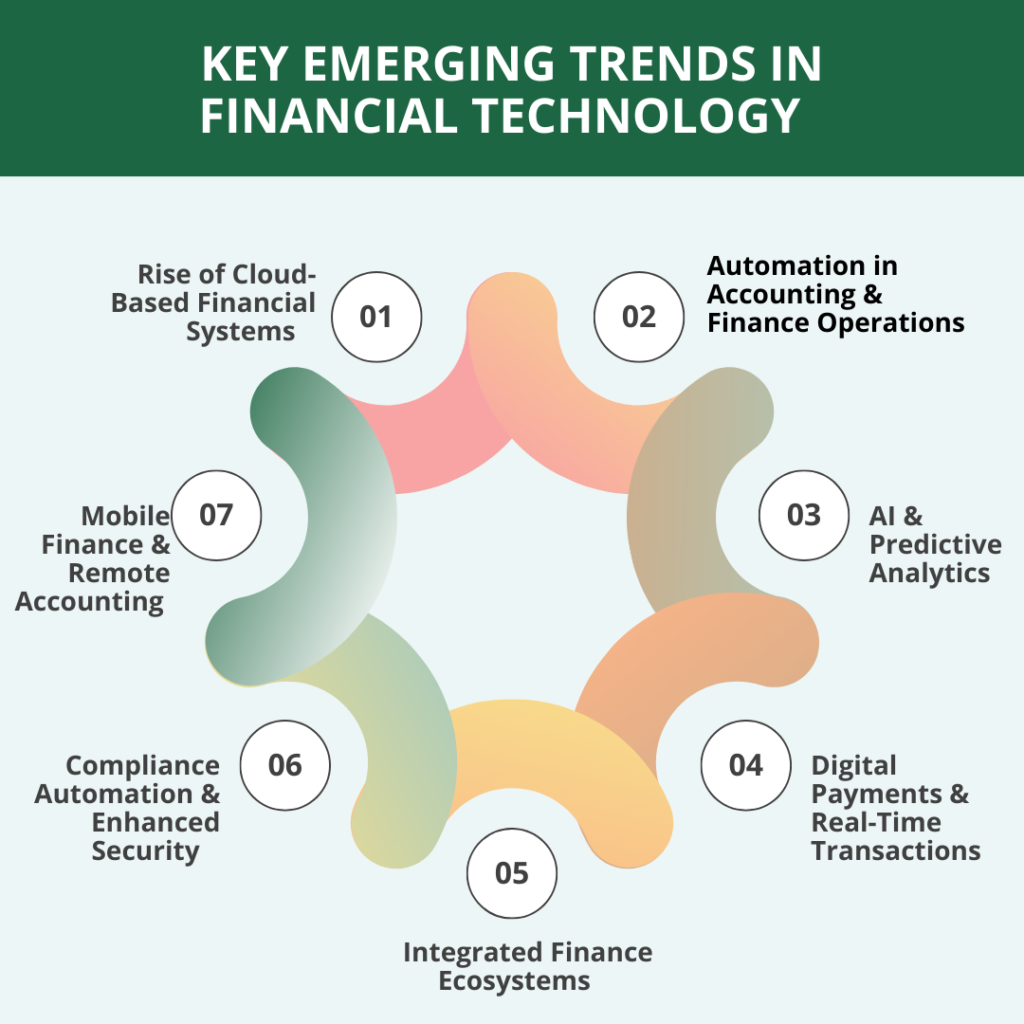

Key Emerging Trends in Financial Technology

a. Rise of Cloud-Based Financial Systems

One of the biggest shifts in the last decade is the movement from traditional on-premise finance systems to cloud-based ERPs and accounting platforms. Companies no longer want to invest heavily in servers, maintenance, or complex installations. Instead, they prefer flexible, cost-effective cloud software that updates automatically and supports remote teams.

Cloud finance systems offer a number of advantages:

- Real-time access to financial data from anywhere

- Reduced IT costs, since no hardware is needed

- Automatic updates with new features and regulations

- Scalability, allowing businesses to grow without system limitations

- Secure storage and backup protection

This shift has made cloud financial systems not just optional, but essential. As more companies embrace hybrid and remote working models, finance teams must have tools that support work from home, office, or on the go.

b. Automation in Accounting & Finance Operations

Automation is transforming finance workflows from slow and manual to efficient and error-free. Modern fintech tools automate:

- Invoicing

- Bank reconciliation

- Approval workflows

- Expense reporting

- Vendor payments

- Tax calculations

- Subscription billing

Instead of spending hours updating spreadsheets or chasing payment approvals, finance teams can allow automated systems to handle repetitive tasks. This shift frees up accountants and finance professionals to focus on strategy, forecasting, and analysis.

Automation also reduces human error, ensures consistent processes, accelerates financial closing cycles, and improves overall compliance.

c. AI & Predictive Analytics

Artificial intelligence has become a powerful force in the finance world. With machine learning models and predictive analytics, finance teams now gain insights that were previously impossible to detect manually.

AI helps organizations:

- Forecast revenue, expenses, and cash flow

- Detect unusual or fraudulent transactions

- Predict late payments and customer behaviour

- Categorize expenses automatically

- Generate insights from large volumes of financial data

Predictive cash flow analytics, automated alerts, and dashboard-level insights help CFOs make data-driven decisions quickly and accurately. AI transforms financial data into actionable intelligence.

d. Digital Payments & Real-Time Transactions

Digital payments have become mainstream across industries. The shift includes:

- UPI adoption

- Digital wallets

- QR-based payments

- Instant settlements

- Online payment gateways

- Multi-currency digital transactions

Customers expect fast, convenient payment options, and businesses require systems that can handle high transaction volumes across multiple channels. Real-time reconciliation is now a necessity to maintain accurate financial records.

Finance teams need tools capable of managing multiple payment methods, integrating with banking systems, and supporting instant settlements without manual intervention.

e. Integrated Finance Ecosystems

Modern companies use multiple systems—CRM for sales, HRMS for employees, inventory software for operations, and project management tools for service delivery. Finance systems must integrate seamlessly with these tools to maintain accuracy and avoid duplication.

Integrated ecosystems ensure:

- Smooth data flow

- No manual re-entry of information

- Accurate reporting

- Connected workflows across departments

- Improved decision-making

Disconnected systems lead to errors, inconsistent data, and wasted time. A unified financial ecosystem solves these problems by keeping every department aligned.

f. Compliance Automation & Enhanced Security

Compliance requirements are becoming stricter across the world. Businesses must follow:

- GST rules

- E-invoicing

- VAT and multi-currency regulations

- Audit trails

- Data privacy standards

Manual compliance processes increase the risk of errors, penalties, and audit failures. Automated compliance reduces these risks by ensuring accuracy, maintaining proper documentation, and providing secure access controls.

Security has also become a major concern, making cloud systems with encryption and role-based permissions essential for protecting financial data.

g. Mobile Finance & Remote Accounting

Finance teams are no longer tied to office systems. With mobile-first applications, they can:

- Approve expense reports

- Send invoices

- View dashboards

- Track inventory

- Receive payment alerts

Remote and hybrid work models demand financial systems that function smoothly on mobile devices. This flexibility helps teams stay productive, even while traveling or working remotely.

How Zoho Finance Apps Align With Trends in Financial Technology

Zoho Finance Suite is built from the ground up to support modern financial operations. It aligns with every major trend reshaping today’s finance landscape.

1. Cloud-Native Architecture

Every application in the Zoho Finance ecosystem is designed as a cloud-native platform. This means:

- All financial data is stored securely in the cloud

- Teams can work from anywhere

- There is no need for servers or installations

- Updates happen automatically

- Collaboration becomes effortless

Whether your finance team is in one office or spread across multiple countries, Zoho ensures consistent access to real-time data.

This cloud foundation makes Zoho a future-ready finance platform suitable for fast-growing businesses.

2. End-to-End Finance Automation

Zoho Finance Suite removes manual work from day-to-day finance tasks. It provides automation across the entire financial lifecycle:

- Zoho Books & Zoho Invoice automate invoicing, billing, reminders, and reconciliation.

- Zoho Expense manages travel and expense reimbursement workflows.

- Zoho Inventory keeps stock levels updated automatically.

- Zoho Billing simplifies recurring billing and subscription management.

- Automated workflows ensure documentation, approvals, and communications follow predefined rules.

- GST filing and tax calculations happen instantly within Zoho Books.

This automation results in:

- Faster financial close cycles

- Fewer data-entry errors

- Smooth workflows

- Increased team efficiency

Finance teams can shift their focus from manual tasks to value-driven activities such as analysis, planning, forecasting, and stakeholder communication.

3. AI Capabilities Powered by Zia

Zoho’s AI engine, Zia, adds intelligence to financial operations.

Zia can:

- Automatically categorise expenses

- Predict late payments and send smart reminders

- Forecast cash flow based on patterns

- Detect anomalies that may indicate fraud

- Analyse financial performance

- Highlight important trends for decision-making

With Zia, finance teams gain an intelligent partner that continuously analyses data and provides insights that would otherwise take hours to identify.

Zia makes finance more proactive, accurate, and insight-driven.

4. Digital Payments & Seamless Banking Integrations

Zoho Finance Suite supports a wide range of payment gateways and banking integrations, ensuring smooth digital transactions.

Supported payment gateways include:

- Razorpay

- PayPal

- Stripe

- Paytm

- WorldPay

Supported banks include:

- ICICI Bank

- HSBC

- Standard Chartered

- Yes Bank

Businesses can:

- Collect payments instantly

- Reconcile payments automatically

- Track settlements in real time

- Offer customers multiple payment options

This reduces delays, improves cash flow, and enhances customer satisfaction.

5. Unified Financial Ecosystem

One of Zoho’s greatest strengths is its fully integrated financial ecosystem. All Zoho Finance applications are integrated and work together seamlessly.

Examples:

- Zoho Books through native integration updates Zoho Inventory in real time

- Zoho CRM syncs deal values with Zoho Books

- Zoho Subscriptions pushes recurring invoice data into Zoho Billing

- Zoho Payroll integrates with Zoho Expense and Zoho Books

This creates a single source of truth for financial information across the organization. Finance teams no longer need to jump between systems or manually enter data in multiple places.

Integrated ecosystems reduce redundancy, eliminate errors, and support fast decision-making.

6. Compliance Made Simple

Zoho Books and other Zoho Finance applications offer strong compliance capabilities:

- GST, VAT, and tax rule automation

- E-invoicing support

- Multi-currency compliance

- Built-in audit trails

- Secure data storage

- Automatic tax calculations

These features help CFOs and finance leaders avoid compliance risks and maintain accurate financial records without extra effort.

7. Mobile-Friendly Finance Operations

Zoho’s mobile apps allow finance teams to work efficiently from anywhere.

Employees and finance leaders can:

- Approve expenses

- Create invoices

- Track payments

- Check inventory

- Analyse dashboards

- Receive updates instantly

Mobile finance operations ensure business continuity and faster responsiveness.

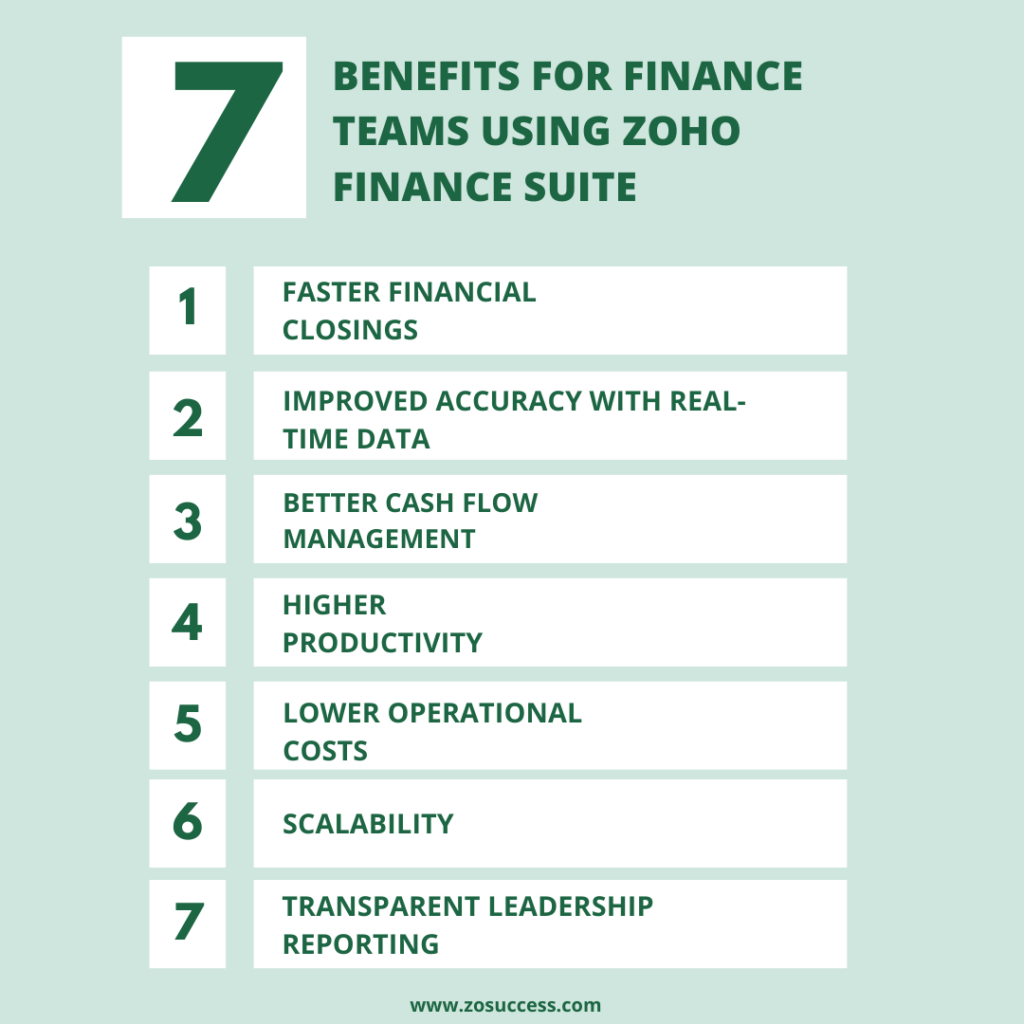

Benefits for Finance Teams Using Zoho Finance Suite

Zoho Finance delivers transformational benefits for finance departments.

- Faster Financial Closings : Automated workflows, smart reconciliation, and integrated systems reduce the time required for monthly and yearly closing.

- Improved Accuracy With Real-Time Data : Because all applications are connected, the data is always updated and synchronised.

- Better Cash Flow Management : Predictive analytics and automated reminders improve collections and reduce delayed payments.

- Higher Productivity : Teams spend less time entering data and more time analysing performance.

- Lower Operational Costs : Cloud-based pricing means no heavy infrastructure or maintenance.

- Scalability : Zoho Finance grows with your business — adding new branches, currencies, products, or teams is easy.

- Transparent Leadership Reporting : Dashboards, audit logs, KPIs, and analytics provide visibility for CFOs and leadership teams.

How Zoho Helps Organizations Stay Competitive

Zoho Finance applications are designed not only for efficiency but also for business growth.

a. Enables Data-Driven Decision-Making

Zoho provides dashboards, KPIs, and analytics that give finance leaders immediate visibility into financial performance. Teams can track profitability, expenses, cash flow, and revenue trends without building manual reports. This real-time intelligence helps leadership make strategic decisions quickly.

b. Speeds Up Revenue Cycles

Automated invoicing, subscription billing, and payment reminders shorten the time between service delivery and cash collection. Faster cash inflow improves working capital and strengthens the company’s financial stability.

c. Supports Growth With Scalability

As businesses expand into new markets or add new product lines, Zoho scales easily. Companies can add new branches, currencies, tax regions, and workflows without facing implementation barriers.

d. Strengthens Customer & Vendor Relationships

With faster billing, accurate statements, real-time updates, and smooth communication, Zoho enhances transparency with both customers and vendors. This leads to higher trust and stronger business relationships.

Why CSOs, CFOs, and Finance Heads Choose Zoho

Senior finance leaders choose Zoho Finance Suite because it offers:

- Lower total cost of ownership (TCO)

- Quick deployment with minimal IT dependency

- Strong integration with Zoho CRM, Zoho Workplace, and third-party apps

- Enterprise-grade security and role-based access

- Continuous innovation with frequent upgrades

Zoho delivers the power of large enterprise ERPs at a fraction of the cost, making it ideal for growing companies.

Dhruvsoft / ZoSuccess Advantage — Your Zoho Finance Transformation Partner

As a trusted Zoho partner, ZoSuccess helps organizations unlock the full potential of the Zoho Finance Suite.

What ZoSuccess Offers

- Finance process assessment & consulting

- Implementation of Zoho Books, Zoho Inventory, and Zoho Subscriptions

- Custom workflows and automation

- Integrations with CRM, payroll, banking, eCommerce

- Training for finance teams

- Zoho Development Services

- Continuous Zoho support, optimization, and maintenance

Why Clients Trust ZoSuccess / Dhruvsoft

- Certified Zoho Finance specialists

- Deep industry experience

- Proven success in digital finance transformation

- Commitment to long-term partnership and excellence

ZoSuccess ensures that every Zoho Finance implementation delivers measurable business value.

Conclusion

The financial landscape is evolving rapidly, driven by AI, automation, cloud systems, digital payments, and real-time data. Organizations that adapt to these trends will enjoy faster processes, greater accuracy, and stronger decision-making capabilities.

Zoho Finance Suite empowers finance teams to embrace the future with confidence. It delivers end-to-end automation, intelligent insights, powerful integrations, compliance support, and scalability — everything modern businesses need to stay competitive.

With ZoSuccess as your partner, your finance transformation becomes smooth, guided, and strategically aligned with business goals.

Looking to modernise your financial systems and stay ahead in the world of digital finance?

Connect with ZoSuccess— your trusted Zoho Finance Implementation Partner — and future-proof your finance operations today.

“ZOSuccess” is the Zoho Consulting Practice of Dhruvsoft Services Private Limited – a leading Zoho Advanced Partner from India – providing services worldwide …

“ZOSuccess” is the Zoho Consulting Practice of Dhruvsoft Services Private Limited – a leading Zoho Advanced Partner from India – providing services worldwide …