If you are a financial controller and you are evaluating Zoho Finance solutions, this article is for you. In today’s fast-paced business environment, financial controllers play a crucial role in steering organizations toward stability, growth, and long-term profitability. They are responsible for overseeing all financial activities, ensuring regulatory compliance, managing financial risks, and delivering accurate financial reporting. With increasing pressure to enhance financial transparency and optimize operational efficiency, the role of a financial controller is becoming more strategic than ever.

To fulfil these responsibilities effectively, financial controllers need reliable, intelligent, and integrated financial management tools. The right finance software not only streamlines day-to-day tasks like invoicing, reconciliation, budgeting, and expense tracking, but it also provides actionable insights that support better decision-making at all levels of the organization.

That’s why selecting the right finance solution is no longer just an IT decision—it’s a critical business move. Choosing software that aligns with your company’s financial goals, compliance requirements, and growth plans is essential for staying competitive. A poorly chosen tool can lead to inefficiencies, data silos, and compliance risks, while the right tool can unlock productivity, accuracy, and financial visibility.

Introducing the Zoho Finance Suite

Enter the Zoho Finance Suite, a powerful collection of cloud-based applications designed to automate and simplify financial operations for growing businesses. From Zoho Books and Zoho Invoice to Zoho Inventory and Zoho Expense, this suite offers end-to-end finance management, seamlessly integrated under one ecosystem. What sets Zoho apart is its focus on usability, scalability, and affordability, making it an attractive choice for mid-sized businesses and enterprises alike.

This article is tailored specifically for financial controllers who are evaluating finance software solutions and want to understand whether Zoho Finance fits their organizational needs. We’ll explore the key considerations that matter most to financial controllers—such as compliance, integration, automation, scalability, and reporting—and assess how the Zoho Finance Suite addresses these priorities.

By the end of this blog, you’ll have a clear understanding of how Zoho Finance can support your financial leadership role, drive efficiency, and contribute to better financial control and decision-making across your organization.

What is Zoho Finance Suite

The Zoho Finance Suite is a comprehensive collection of cloud-based applications designed to manage various financial operations within a business. Each application addresses specific financial tasks, and together, they provide an integrated platform for end-to-end financial management.

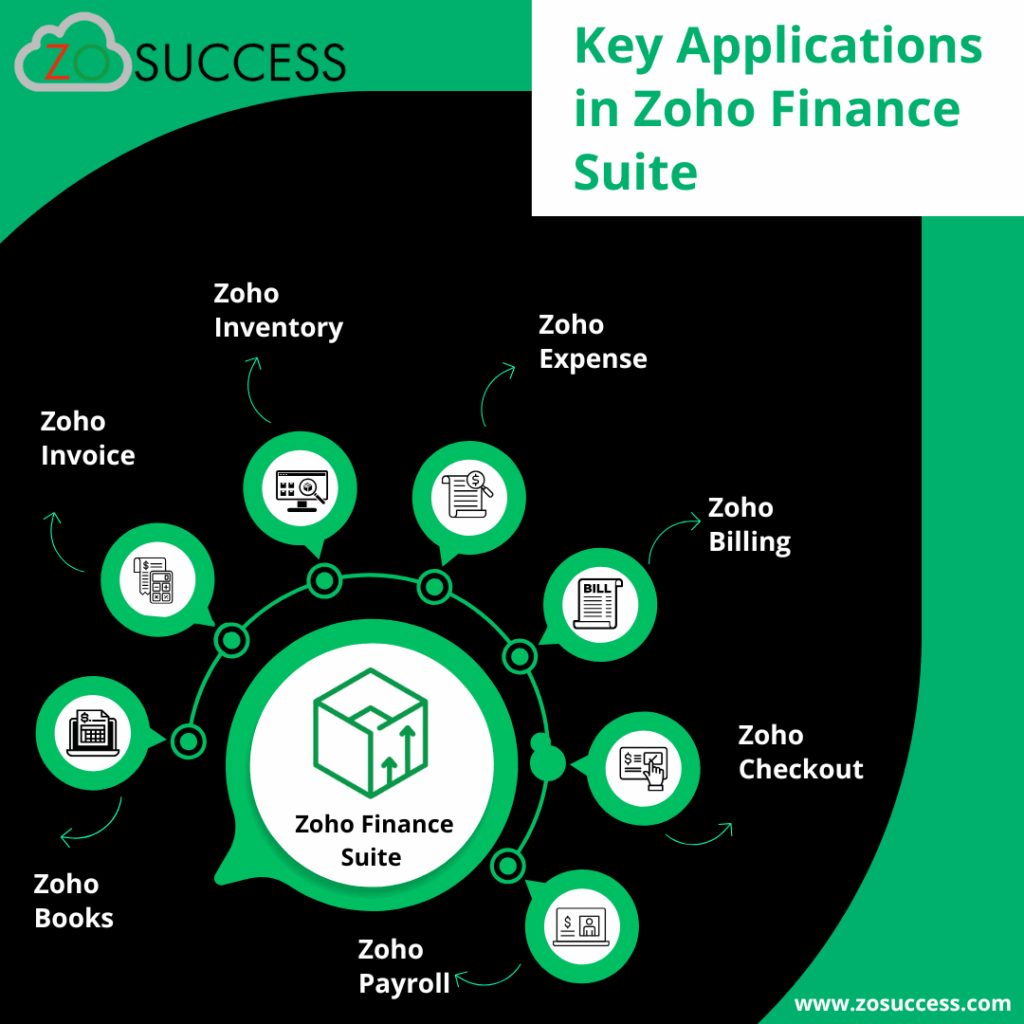

Key Applications in Zoho Finance Suite

- Zoho Books: A robust accounting software that manages finances, tracks expenses, and generates insightful reports. It offers features like automatic bank feeds, invoicing, expense tracking, and project time tracking, facilitating efficient financial management for businesses of all sizes.

- Zoho Invoice: It allows you to create professional invoices, send payment reminders, and accept online payments. This streamlines invoicing and speeds up payments, boosting your cash flow.

- Zoho Inventory: A business inventory system that streamlines order management, monitors stock quantities, and supports various sales platforms. It guarantees efficient inventory management and timely order completion.

- Zoho Expense: This tool makes expense reporting easy by automating how business expenses are recorded and approved. It includes features like receipt scanning, policy checks, and managing reimbursements.

- Zoho Billing: An end-to-end billing solution for growing businesses, handling subscription billing, recurring payments, and customer lifecycle management.

- Zoho Checkout: A straightforward application for creating customized, secure payment pages to collect one-time or recurring online payments without any coding knowledge.

- Zoho Payroll: A cloud-based payroll management solution that automates payroll processing, tax calculations, and employee payments, ensuring compliance with local tax regulations.

Integration with the Zoho Ecosystem

One of the standout features of the Zoho Finance Suite is its seamless integration with other Zoho applications and third-party services, creating a unified business ecosystem:

- Zoho CRM: Integrating with Zoho CRM allows for a cohesive flow of customer information between sales and finance teams, enhancing customer relationship management and financial operations.

- Zoho Analytics: This integration enables advanced data analysis and visualisation, providing deeper insights into financial data and aiding strategic decision-making.

- Zoho Projects: Combining with Zoho Projects facilitates the linking of project management with financial tracking, ensuring accurate budgeting and expense management for projects.

- Zoho People: Integrating with Zoho People streamlines HR and payroll processes, ensuring accurate employee records and payroll management.

These integrations ensure real-time data synchronisation across departments, reducing manual data entry and enhancing overall operational efficiency.

Key Strengths of Zoho Finance Suite – Cloud-Based, Scalable, and Tax Compliant

The Zoho Finance Suite is built on a cloud-based platform, offering several advantages:

- Accessibility: Access financial data and perform operations from anywhere at any time, using various devices, including desktops, laptops, tablets, and smartphones.

- Scalability: The suite is designed to grow with your business, accommodating increased transactions, users, and complex financial processes without compromising performance.

- Tax Compliance: Zoho Finance applications are equipped to handle various tax regulations, including GST (India) and VAT compliance and e-invoicing (India) mandates, ensuring that businesses adhere to local tax laws effortlessly.

By leveraging the Zoho Finance Suite, financial controllers can ensure streamlined financial operations, maintain compliance with tax regulations, and support the organization’s growth with a scalable and integrated financial management system.

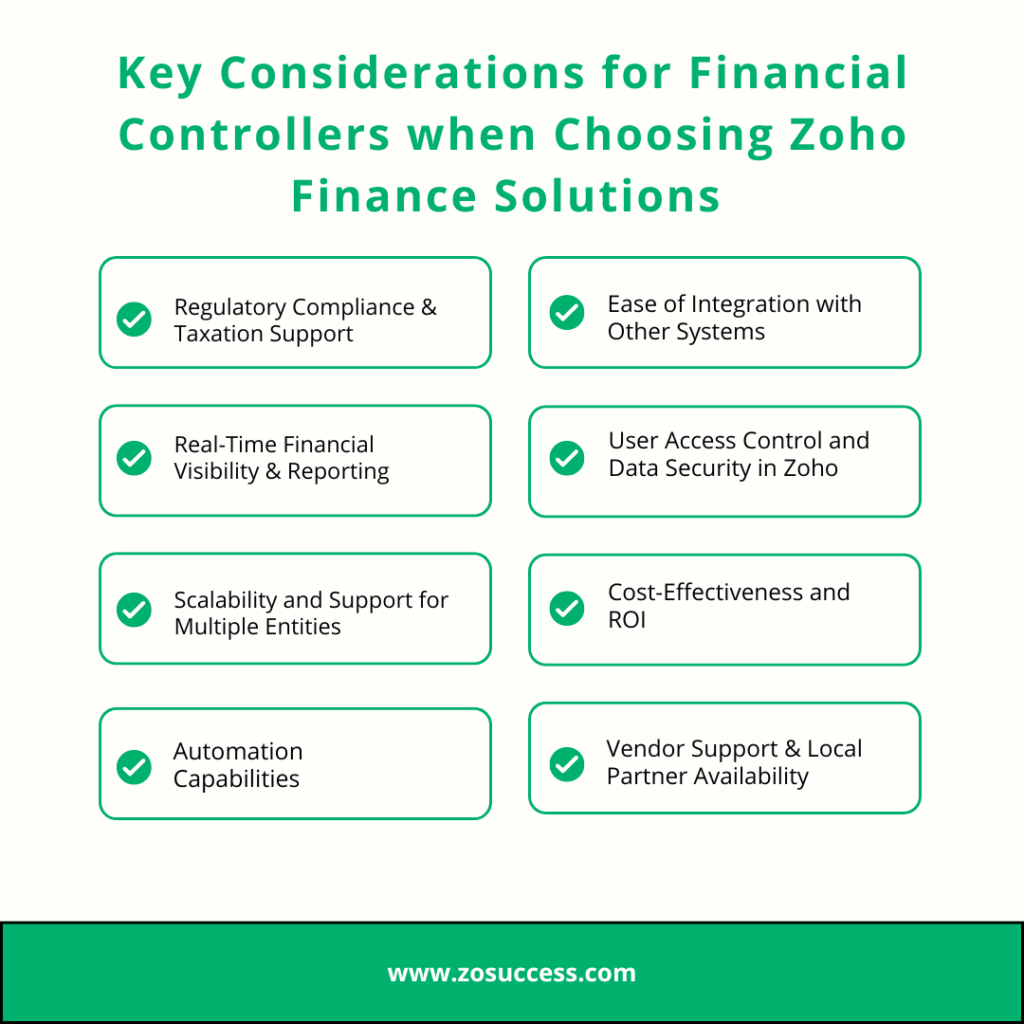

Key Considerations for Financial Controllers when Choosing Zoho Finance Solutions

When evaluating Zoho Finance Suite for your organization, financial controllers should focus on several critical factors to ensure the solution aligns with business needs and regulatory requirements.

Regulatory Compliance & Taxation Support

- GST Readiness (India), VAT (Global), and Audit Trails: Zoho Finance Suite is equipped to handle various tax structures, including India’s GST and global VAT systems. It maintains comprehensive audit trails, facilitating transparency and compliance during financial audits.

- Country-Specific Compliance Automation: The suite offers features tailored to meet specific regional tax laws and financial regulations, ensuring adherence to local compliance standards.

Real-Time Financial Visibility & Reporting

- Custom Dashboards and Reports: Zoho Finance Suite provides customizable dashboards and reporting tools, enabling real-time monitoring of financial performance and informed decision-making.

- Integration with Zoho Analytics: Seamless integration with Zoho Analytics allows for advanced data analysis and visualisation, offering deeper insights into financial data.

- Role-Based Access and Decision – Making Support: The system supports role-based permissions, ensuring that sensitive financial information is accessible only to authorized personnel, thereby enhancing security and facilitating structured decision-making.

Scalability and Support for Multiple Entities

- Managing Multiple Businesses or Subsidiaries: Zoho Finance Suite allows for the management of multiple organizations under a single account, streamlining operations across various business entities.

- Consolidated Financials and Inter-Company Transactions: The suite facilitates consolidated financial reporting and efficient handling of inter-company transactions, providing a holistic view of the organization’s financial health.

Automation Capabilities

- Automating Invoicing, Payments, and Recurring Billing: Automation features reduce manual intervention in invoicing and payment processes, enhancing efficiency and reducing errors.

- Expense Tracking and Approvals: The system streamlines expense reporting and approval workflows, ensuring timely reimbursements and accurate expense management.

- Workflow Rules and Triggers: Customizable workflows and triggers automate routine tasks, allowing finance teams to focus on strategic activities.

Ease of Integration with Other Systems

- Seamless Integration with Zoho CRM, Payroll, Projects, Inventory, etc.: Zoho Finance Suite integrates effortlessly with other Zoho applications, creating a unified platform for various business operations.

- API Availability for Third-Party Integrations: Robust APIs enable integration with third-party systems, ensuring flexibility and adaptability to existing workflows.

User Access Control and Data Security in Zoho

- Role-Based Permissions: Granular access controls ensure that employees have appropriate access to financial data based on their roles, enhancing security.

- Audit Trails and Data Logs: Comprehensive audit trails and data logs provide transparency and accountability in financial transactions.

- Compliance with Data Protection Regulations: Zoho Finance Suite adheres to global data protection standards, ensuring that financial data is handled securely and in compliance with relevant regulations.

Cost-Effectiveness and ROI

- Comparing Cost vs. Features vs. Business Needs: Zoho Finance Suite offers a balance between cost and functionality, providing features that align with various business requirements without unnecessary expenditure.

- ROI from Automation, Accuracy, and Time Saved: The automation and accuracy provided by the suite contribute to significant time savings and operational efficiency, leading to a favourable return on investment.

Vendor Support & Local Partner Availability

- Zoho’s Support Ecosystem: Zoho offers a robust support system, including documentation, tutorials, and customer service, ensuring users have access to assistance when needed.

- Value of Working with Zoho Partners: Collaborating with Zoho partners can provide additional implementation support, customization, and training, enhancing the overall user experience.

- Training, Onboarding, and Post-Implementation Support: Comprehensive training and onboarding programs, along with ongoing support, ensure that organizations can maximize the benefits of the Zoho Finance Suite.

Comparing Zoho with Other Financial Platforms

| Feature | Zoho Finance Suite | Tally | SAP |

|---|---|---|---|

| Cloud-Based Accessibility | Yes (Cloud-based, accessible anywhere) | Limited (Traditional, mainly on-premise) | Yes (Cloud-based, enterprise-level) |

| Integration with Other Tools | Seamless integration with Zoho CRM, Projects, Inventory, and HRMS | Limited integration with third-party apps | Requires additional configuration for integrations & additional paid licenses |

| Customization & Flexibility | High (Custom workflows, automated processes) | Limited (Standard accounting functionalities) | Extensive (Customizable ERP) but cost is high |

| Multi-Entity & Multi-Currency Support | No for multiple legal entities, Yes for multi-currencies | No (Mostly for single entity businesses) | Yes (Multi-entity and multi-currency) |

| Automation Features | Advanced (Invoicing, payments, recurring billing, expense tracking) | Basic (Manual invoicing and billing) | Extensive (Advanced workflows and automation) |

| Reporting & Analytics | Advanced (Customizable dashboards, real-time insights) | Basic (Limited reports and analytics) | Advanced (Comprehensive reporting suite) |

| Ease of Use | User-friendly, intuitive interface | Steep learning curve | Complex interface requires training |

| Cost | Affordable (Scalable pricing for businesses of all sizes) | Cost-effective (Low initial cost) | Expensive (Enterprise-level pricing) |

| Support & Training | Strong (Online resources, webinars, Zoho partners for training) | Basic (Limited support and training) | Extensive (Training, consulting available) |

| Regulatory Compliance | GST (India), VAT (Global), Tax compliant | GST, Tax compliant (India-specific) | Global compliance (Enterprise-level) |

| Scalability | High (Grows with the business, supports multiple entities) | Limited scalability | Very High (Enterprise-level scalability) |

How Zoho Stands Out for Mid-Sized Businesses and Growing Enterprises

Zoho’s cloud-based financial solutions are uniquely positioned to meet the evolving needs of mid-sized businesses and growing enterprises. Here’s how Zoho Finance Suite stands out when compared to Tally and SAP:

Cost-Effective for Growing Enterprises

- Zoho Finance Suite offers a cost-effective solution with a scalable pricing model, making it an ideal choice for growing businesses. The flexibility to pay for only the features needed allows businesses to control costs while scaling up. This pricing model ensures that businesses don’t have to pay for excess functionality, which is common in more rigid solutions like SAP.

- Tally, while affordable, lacks the advanced features and cloud-based accessibility of Zoho. It’s more suited for smaller businesses that don’t need scalability or extensive integrations.

- SAP, on the other hand, is a highly expensive enterprise-level solution. It’s designed for large organizations with complex needs, making it cost-prohibitive for mid-sized businesses looking for a scalable, affordable option.

Scalability and Flexibility

- Zoho Finance The suite is built to scale with your business growth. Whether you need to manage multiple entities, handle international taxes, or perform detailed financial reporting, Zoho provides the right tools without needing major upgrades or changes. Tools like Zoho Books and Zoho Analytics expand with your business, making it easy to scale your operations.

- Tally is limited when it comes to scalability. It’s best suited for single-entity businesses and lacks features for handling multiple subsidiaries or more complex financial operations.

- SAP offers extensive scalability, but it is designed primarily for large enterprises and can be complex to implement. The enterprise-level scalability often comes at the cost of usability and higher overhead costs, making it less ideal for mid-sized businesses.

Integrated Ecosystem

- Zoho Finance Suite offers an integrated ecosystem that connects all Zoho applications like Zoho CRM, Zoho Projects, Zoho People, and Zoho Inventory. This seamless integration ensures smooth workflows across departments and eliminates the need for multiple third-party applications.

- Tally lacks this level of integration. It mainly focuses on accounting, and while it supports basic integration with a few third-party tools, it’s not part of a larger ecosystem, which can create data silos and inefficiencies.

- SAP, while offering powerful integrations within its ERP suite, requires significant customization and additional configuration to achieve seamless integration with third-party tools. This can be time-consuming and costly, especially for mid-sized businesses.

Advanced Automation and Customization

- Zoho Finance Suite excels in automation with features like automated invoicing, recurring billing, expense tracking, and approval workflows. The system is highly customizable, allowing businesses to tailor the software to their needs without external developers.

- Tally offers basic automation (manual invoicing and billing), but lacks the extensive automation features available in Zoho. Its flexibility is limited, especially for businesses requiring more complex workflows.

- SAP provides advanced automation but comes with a high level of complexity that requires specialized knowledge. The customization and automation options are powerful but often require additional resources and higher costs.

Comprehensive Reporting and Analytics

- Zoho Finance Suite provides advanced reporting and analytics features, including customizable dashboards, real-time insights, and detailed financial reports. Zoho Analytics integrates seamlessly with Zoho Books, enabling businesses to make data-driven decisions.

- Tally offers basic reporting but lacks the depth and flexibility of Zoho’s reporting tools. It’s designed for simpler financial reporting, making it less suitable for businesses looking for detailed insights or advanced forecasting.

- SAP provides comprehensive reporting and analytics, but it comes with the complexity and enterprise-level cost that may be overkill for mid-sized businesses. While powerful, SAP’s reporting capabilities often require a steep learning curve and significant resources to manage.

Support for multiple currencies and entities.

- Zoho Finance Suite excels in multi-currency, allowing businesses to manage global finances effortlessly. You can create multiple entities by having multiple ORGs under same login. However consolidation needs to be done using Zoho Analytics. This is crucial for mid-sized businesses expanding into international markets or managing multiple subsidiaries.

- Tally is limited in this area. It does not support multi-currency or multi-entity management, which makes it less suitable for businesses with international operations.

- SAP offers multi-currency and multi-entity support but at an enterprise scale. The level of complexity involved in managing global operations may not be practical for mid-sized businesses that need a more straightforward solution.

Customer Support and Training

- Zoho Finance Suite provides excellent customer support, with access to a wide range of online resources, webinars, and Zoho partners for training and onboarding. This ensures that businesses can get up to speed quickly and efficiently without relying on expensive consultants.

- Tally offers basic support, mainly through its help desk and limited online resources. The lack of extensive support options can be a drawback for businesses looking for comprehensive assistance.

- SAP provides extensive support, but it can be expensive and often requires specialized consultants. Due to the complexity of SAP, businesses often need to invest heavily in training and support.

For mid-sized businesses and growing enterprises, Zoho Finance Suite offers a cost-effective, scalable, and integrated solution that supports business growth while providing essential features such as advanced automation, multi-currency and multi-entity support, and detailed reporting. While Tally is suited for smaller businesses with basic needs, and SAP is designed for large enterprises, Zoho provides a perfect balance of affordability, flexibility, and advanced capabilities for businesses in the growth phase.

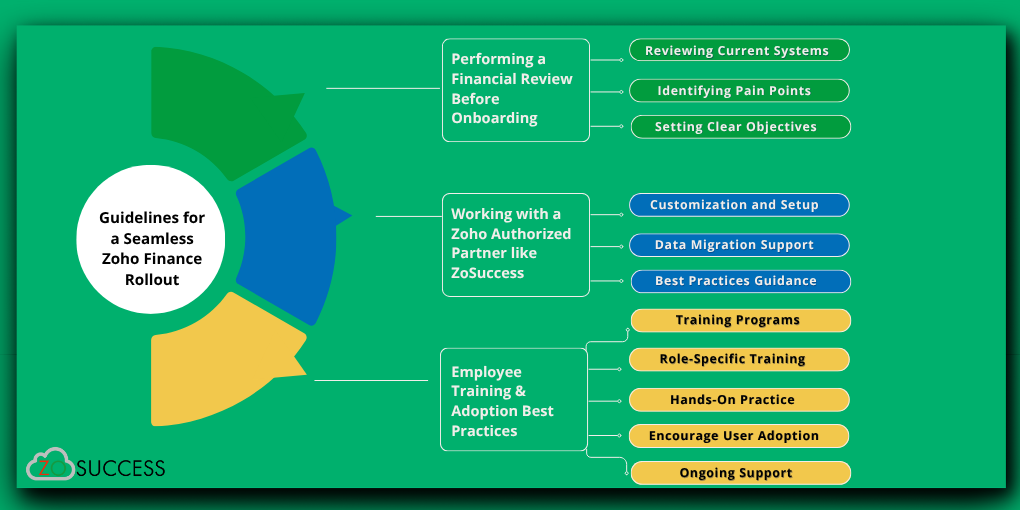

Guidelines for a Seamless Zoho Finance Rollout

Successfully implementing Zoho Finance Suite can significantly streamline financial operations, improve accuracy, and drive efficiency across your business. However, for a smooth transition and optimal use of the system, it’s essential to follow certain best practices. Below are key tips to ensure a successful implementation:

Performing a Financial Review Before Onboarding

Before starting the implementation process, it’s crucial to conduct a thorough financial audit. This step helps you assess your current financial processes, identify inefficiencies, and pinpoint areas for improvement. The audit should include:

- Reviewing current systems: Understand the strengths and weaknesses of your existing financial systems, whether they are manual or software-based.

- Identifying pain points: Are there issues with invoicing, reporting, or expense tracking? Knowing where your challenges lie will help you leverage Zoho’s features effectively.

- Setting clear objectives: Define what success looks like for your business with Zoho Finance Suite. Are you looking to reduce manual errors, enhance reporting accuracy, or streamline workflows? Clear goals will guide the implementation and ensure alignment with business needs.

Conducting a financial audit not only ensures that Zoho is the right choice but also sets the foundation for better data migration and a smoother transition to the new system.

Working with a Zoho Authorized Partner like ZoSuccess

One of the best ways to ensure a smooth implementation of Zoho Finance Suite is to work with a Zoho Authorized Partner, such as ZoSuccess. Partnering with experts who are familiar with Zoho’s ecosystem brings several advantages:

- Customization and setup: Zoho Authorized Partners like ZoSuccess can help tailor the platform to meet your specific business needs, ensuring a seamless configuration of modules like Zoho Books, Zoho Inventory, and Zoho Analytics.

- Data migration support: Migrating your existing financial data to Zoho can be tricky, especially if you’re transitioning from outdated systems. Zoho partners have the experience to handle data migration smoothly, ensuring no data loss and that everything is properly integrated.

- Best practices: Authorized partners are knowledgeable in best practices for setting up Zoho Finance Suite, ensuring you are using the platform’s features to their full potential and avoiding common pitfalls.

Working with a Zoho partner provides not only technical expertise but also strategic advice on how to maximize the value of the Zoho suite for your business.

Employee Training & Adoption Best Practices

Once Zoho Finance Suite is implemented, it’s important to ensure that your employees are adequately trained and that the new system is adopted smoothly across your organization. Consider the following best practices for training and adoption:

- Comprehensive Training Programs: Ensure all employees, from financial controllers to sales teams, understand how to use the system effectively. Conduct training sessions, both in-person and virtual, that cover core features, such as invoicing, expense tracking, reporting, and integrations.

- Role-Specific Training: Different employees will use the system in different ways. Offer role-based training tailored to specific job functions, ensuring each department knows how to leverage Zoho Finance Suite for their needs. For example, accountants may need more advanced training on Zoho Books, while sales teams need to understand Zoho Subscriptions.

- Hands-On Practice: Create a test environment where employees can practice using the system before it goes live. This will help them feel more comfortable and confident when the system is fully implemented.

- Encourage User Adoption: To drive user adoption, it’s important to involve employees early in the process. Explain how Zoho will make their tasks easier and help them understand the benefits of the new system. Highlight features like automation, customizable reporting, and real-time data access to demonstrate its advantages.

- Ongoing Support: Post-implementation support is critical for ensuring successful adoption. Establish a support system, whether through internal help desks or leveraging Zoho’s customer support channels. Regularly check in with employees to address any issues they encounter as they become more familiar with the system.

By ensuring that employees are trained and confident in using Zoho Finance Suite, you’ll not only reduce frustration but also maximize the return on your investment.

Conclusion

As financial controllers play a pivotal role in managing a company’s financial health, it’s essential for them to carefully evaluate key aspects when selecting finance tools. From regulatory compliance and scalability to automation and integration, the right financial software can significantly impact operational efficiency, data accuracy, and overall business growth.

Aligning your finance tools with your business goals is not just a matter of functionality but of ensuring that your software can evolve with your company’s needs. The right tools can empower your team, streamline processes, and provide the insights necessary for making strategic financial decisions.

Before committing to a solution, it’s highly recommended to consult with Zoho experts who can guide you through the complexities of choosing the right applications for your business. Zoho’s suite of finance apps is designed to cater to various business requirements, but finding the perfect match requires expertise and understanding of your specific goals.

“Need help choosing the right Zoho Finance apps?”

Contact ZOSuccess today for a personalized consultation. Our team of Zoho experts is here to help you select the best finance solutions tailored to your business needs.

Click here to get in touch with ZOSuccess or explore Zoho Finance Services for more details.

“ZOSuccess” is the Zoho Consulting Practice of Dhruvsoft Services Private Limited – a leading Zoho Advanced Partner from India – providing services worldwide …

“ZOSuccess” is the Zoho Consulting Practice of Dhruvsoft Services Private Limited – a leading Zoho Advanced Partner from India – providing services worldwide …